.png)

One Person Company (OPC)

One Person Company is a company that comprises a single person as a shareholder and can be contrasted with private companies. These companies get all the benefits of a private company such as they to have access to credits, bank loans, limited liability, legal protection, etc.

Private Limited Company (PVT)

A private company is a company which is owned by non-governmental organisations or a relatively small number of shareholders or members of a company. Usually, a private company does not offer or trade its shares to the general public on the stock exchanges, but rather the private stock of the company is owned and traded

Limited Liability Partnership (LLP)

A limited liability partnership is a partnership in which some or all partners have limited liabilities. It therefore can exhibit elements of partnerships and corporations. In an LLP, each partner is not responsible or liable for another partners misconduct or negligence

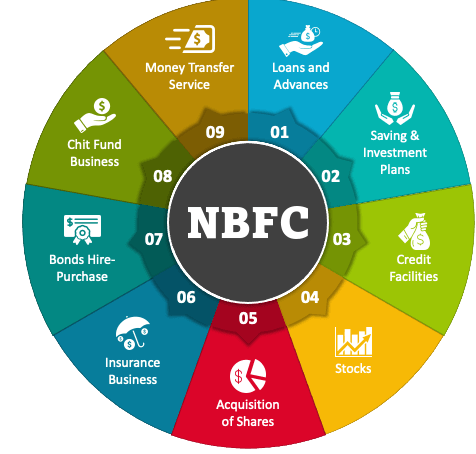

Non-Banking Financial Company (NBFC)

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance.

Sec.8 Company

A company is referred to as Section 8 Company when it registered as a Non-Profit Organization (NPO) i.e. when it has motive of promoting arts, commerce, education, charity, protection of environment, sports, science, research, social welfare, religion and intends to use its profits (if any) or other income for promoting these objectives.

Trust Registration

These organizations work for companies at large and undertake public welfare activities with a charitable purpose. Such purposes may include social contribution in the form of education, medical help or undertaking activities of public utility that promote public welfare.

Thus, the most preferred way to run an NGO or a non – profit organization is to form a Public Charitable Trust. A Trust can be a private or public Trust depending upon the class of people that receive benefits. Furthermore, the main intent of running a Trust is to transfer the property to the beneficiary.

INCOME TAX REGISTRATION

PAN NUMBER

It also serves as an identity proof. PAN is mandatory for financial transactions such as receiving taxable salary or professional fees, sale or purchase of assets above specified limits, buy mutual funds and more. The PAN number remains unaffected by change of address throughout India.

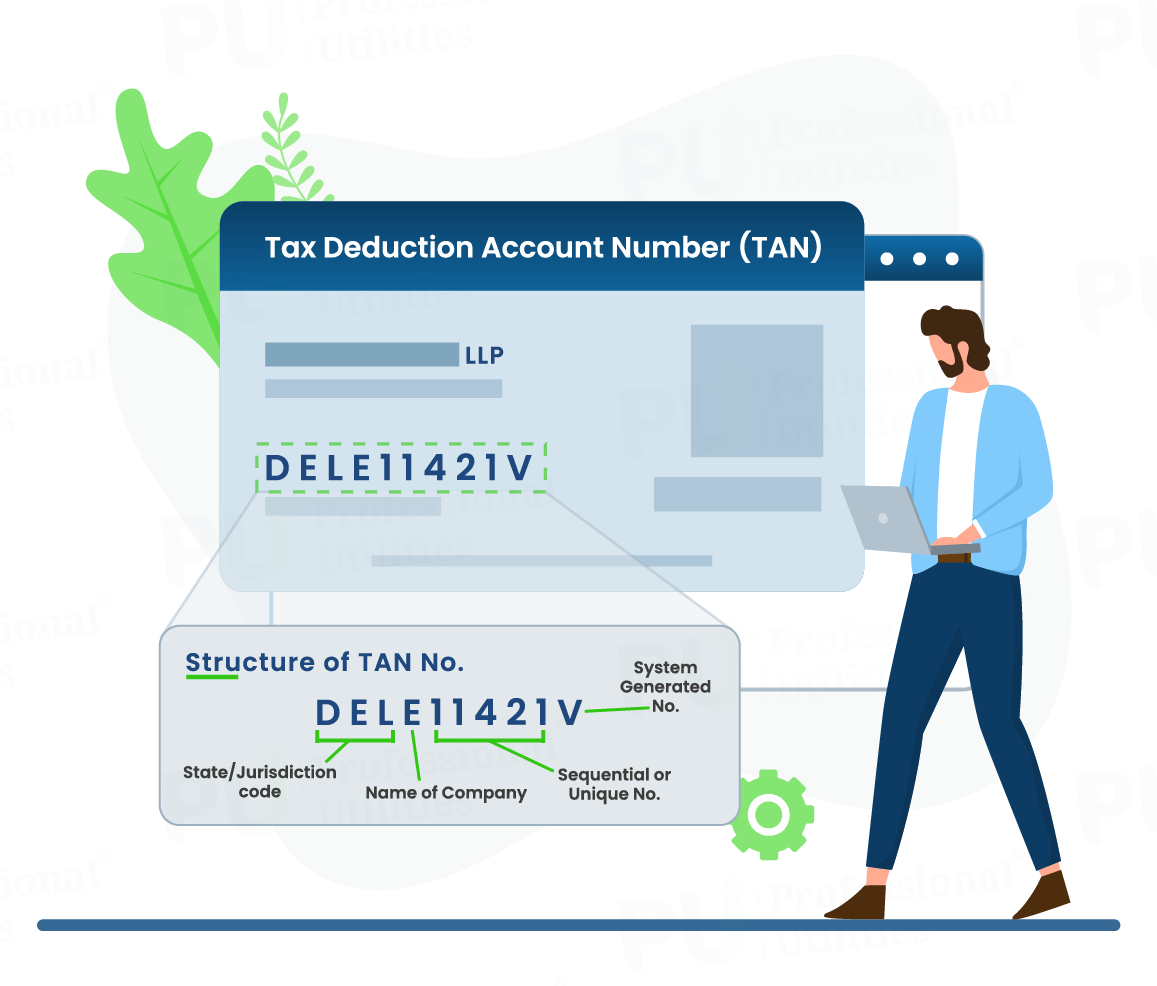

TAN NUMBER

Tax Deduction Account Number or Tax Collection Account Number is a 10 -digit alpha-numeric number issued by the Income-tax Department. TAN is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS).

AIN NUMBER

AIN or Account Office Identification Number is a special 7 digit identification number provided to each accounts office by the Directorate of the Income Tax System, Delhi. It is mandatory for every Accounts Office to have an Account Identification Number while submitting Form 24G.

GST REGISTRATION

GST is a single tax right from the manufacturer or service provider to the consumer. In this system, taxes paid at each stage will be credited in the subsequent stage of value addition. Thus, Goods and Services Tax charged by the final dealer (seller or service provider) is the final tax borne by the customer, with set off of all taxes paid at all earlier stages in the supply chain.

IMPORT AND EXPORT REGISTRATIONS

IEC (Import Export Code) is required by anyone who is looking to kick-start his/her import/export business in the country. It is issued by the DGFT (Director General of Foreign Trade). IEC is a 10-digit code which has a lifetime validity. Predominantly importers merchant cannot import goods without the Import Export Code and similarly, the exporter merchant cannot avail benefits from DGFT for the export scheme, etc. without IEC.

EPF REGISTRATION

PF registration is mandatory for all establishments with 20 or more persons. Some establishments having less than 20 employees would also be required to obtain PF registration. All employee become eligible for a PF right from the commencement of employment and the onus of deduction & payment of PF is with the employer.

ESI REGISTRATION

ESI stands for Employee State Insurance managed by the Employee State Insurance Corporation which is an autonomous body created by the law under the Ministry of Labour and Employment, Government of India. This scheme was started for Indian workers. This scheme was started for Indian workers. The workers are provided with a huge variety of medical, monetary and other benefits from the employer. Any non-seasonal factory and company having more than 10 employees (in some states it is 20 employees) who have a maximum salary of Rs. 21,000/- has to mandatorily register itself with the ESIC.

LABOUR LICENSE

It applies to any establishment in which twenty or more workmen are employed on any day of the of the accounting year as contract labour. It applies to any contractor who employs or who employed twenty or more workers on any day of the accounting year. The Contract Labour (Regulation and Abolition) Act has been enacted by the Indian Legislature from the year 1970. The act intends to prohibit the employment of contract labour in certain circumstances and to regulate the working conditions of contract labour during employment.

SHOPS & ESTABLISHMENTS REGISTRATION

Shops and Establishment Act regulates shops, commercial establishments, hotels, clubs, restaurants, eating houses and other places of public amusement or entertainment. Shops and Establishment registration is covered under the state laws of India. Every state has its different set of laws for Shops and Establishment and they are to be followed properly. The employer of every shop/establishment is required to get itself registered under this Act within 30 days of commencement of work. Registration under the Shops and Establishment Act in the case of small businesses including proprietorship firms in the unorganized sector, it serves as a proof for the existence of the business. The Shops and Establishment Act registration controls various terms of employment such as payment of wages, work hours, the interval for rest, meals, holidays, leave, and other situations of work of individuals working in various establishments. This registration is necessary for each business place of work excluding those who already come under the Factories Act 1948. Shops & Establishment Registration Certificate is a basic license and required to submit while applying for other licenses. For instance, it is required by most banks as proof of commercial business for the opening of the current account.

GEM (Government E-Marketing)

The GEM (Government e-Marketplace) is a government-run e-commerce portal to facilitate and enable easy online acquisition of the Consumer Goods & Services that are needed by various Organizations, Government Departments and PSUs. The government under the Allocation of Business Rules, 1961 had started the GeM in 2017. The main purpose of the GeM is to assure clarity, productivity, and promptness in the obtainment of supplies.

E-TENDER

- Bidder should do Online Enrolment in this Portal using the option Click Here to Enroll available in the Home Page. ...

- Bidder then logs into the portal giving user id / password chosen during enrollment.

- The e-token that is registered should be used by the bidder and should not be misused by others.

PARTNERSHIP REGISTRATION

A Partnership is one of the most important forms of a business organization, where two or more people come together to form a business and divide the profits thereof in an agreed ratio. A Partnership is easy to form, and compliance is minimal as compared to companies. Indian Partnership Act, 1932 governs the partnerships. Registration of partnership firm is optional and at the discretion of the partners. Registration of partnership firm may be done at any time – before starting a business or anytime during the continuation of the partnership. It is always advisable to register the firm since registered firms enjoy special rights which aren’t available to unregistered firms. A partnership deed is an agreement between the partners in which rights, duties, profits shares and other obligations of each partner is mentioned. A partnership deed can be written or oral, although it is always advisable to write a partnership deed to avoid any conflicts in the future.